AI Finance in 2025: How AI Supercharges Your Money

AI finance refers to the use of artificial intelligence to automate and enhance financial management tasks like budgeting, investing, fraud detection, and personalized recommendations. In 2025, AI finance isn’t just a buzzword anymore—it’s your banker, your budget buddy, your late-night spending conscience. If you’re still managing money the old way, you’re honestly leaving cash on the table.

Real story, I downloaded a savings app last month that uses AI. Week one, it noticed my ridiculous food delivery habit. Week two, it created a “late-night cravings” category and capped it. Week three? I cooked. Miracles do happen.

The Real Benefits of AI Finance

Here’s the deal: AI doesn’t just make banking faster. It makes it smarter. No more logging receipts or stressing over budgets. AI sorts, learns, and alerts all in real time.

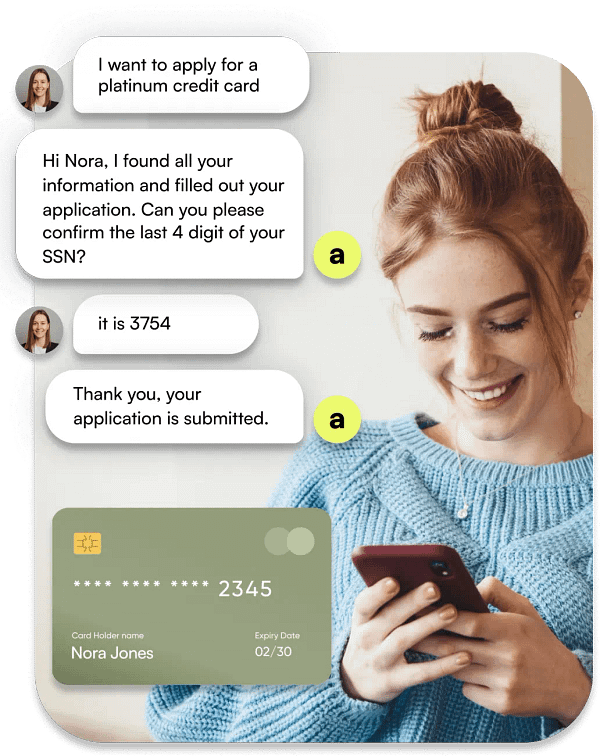

Worried about security? Don’t be. AI spots sketchy transactions before they become a problem. Think of it like a digital guard dog—one that never sleeps and reads every fine print.

Then there’s personalization. AI watches your patterns and offers dead-on suggestions. It’s like having a money coach that knows when you’re about to impulse buy… and talks you down, gently.

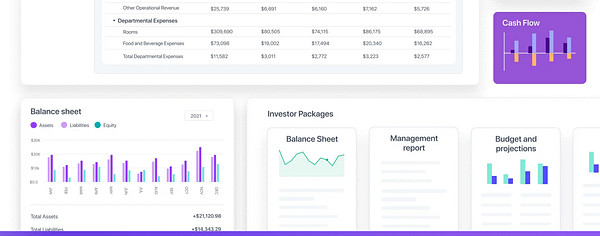

What People Actually Do With AI Finance

So how’s this stuff showing up in real life? Simple:

- Chatbots: These aren’t the clunky bots from 2018. They’re sharp. Ask anything “What’s my balance?” “Did my rent go through?” and they get it right.

- Robo-advisors: Apps like Wealth front or Betterment invest your money based on goals you set. Low risk? High growth? It adapts.

- Smart alerts: AI flags weird patterns like blowing $80 on coffee in four days and says, “Hey, wanna cool it?”

Even budgeting tools are getting sassier. Forbes’ top apps like Cleo, YNAB, and Digit now use AI to keep you on track with humor.

What’s Coming Next in AI Finance

Okay, let’s talk what’s next—and some of it sounds like sci-fi:

- Quantum-enhanced AI: This isn’t just fast. It’s blink-and-it’s-done fast. Algorithms will handle investment scenarios we haven’t even dreamed of yet.

- AI-powered DeFi: Peer-to-peer loans and decentralized banking will finally get user-friendly, thanks to AI filtering out scams and bad actors.

- Emotional AI: Yep, it’s a thing. Apps might soon read stress signals and suggest money moves based on how you feel—not just what you earn.

And let’s not forget the ethical push. Companies are being called out to explain how their AI works, especially in lending and credit scoring. About time, right?

Common Questions About AI Finance

What is AI finance?

It means using artificial intelligence to automate, protect, and improve financial tasks like budgeting, investing, and fraud detection.

Can AI really stop fraud?

Yup. It sees patterns that humans miss and shuts shady stuff down fast.

Is it safe to trust AI with my money?

Mostly, yes. Good tools use encryption and human checks. Just stick with apps that are well-reviewed and secure.

Will AI replace human financial advisors?

Nope. It’ll just make them better, like giving them superpowers for number crunching.

What apps use AI right now?

Apps like Cleo, YNAB, Mint, and Digit already use AI to help you budget, save, and spend smarter.

Conclusion

AI in finance isn’t a someday thing. It’s already changing how we spend, save, and plan. Wanna see what it can do for your money? Dive into our AI Finance hub and try it out.